All about Amur Capital Management Corporation

All about Amur Capital Management Corporation

Blog Article

Fascination About Amur Capital Management Corporation

Table of ContentsAmur Capital Management Corporation for DummiesFascination About Amur Capital Management CorporationWhat Does Amur Capital Management Corporation Mean?The Ultimate Guide To Amur Capital Management CorporationAmur Capital Management Corporation Can Be Fun For AnyoneThe 45-Second Trick For Amur Capital Management CorporationThe Basic Principles Of Amur Capital Management Corporation

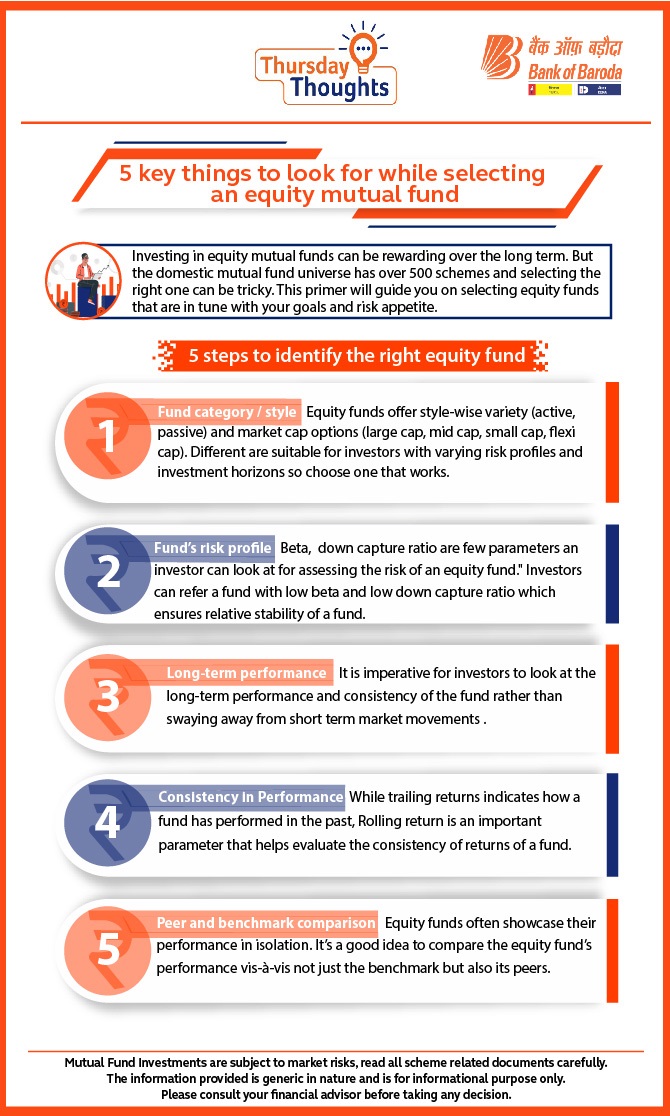

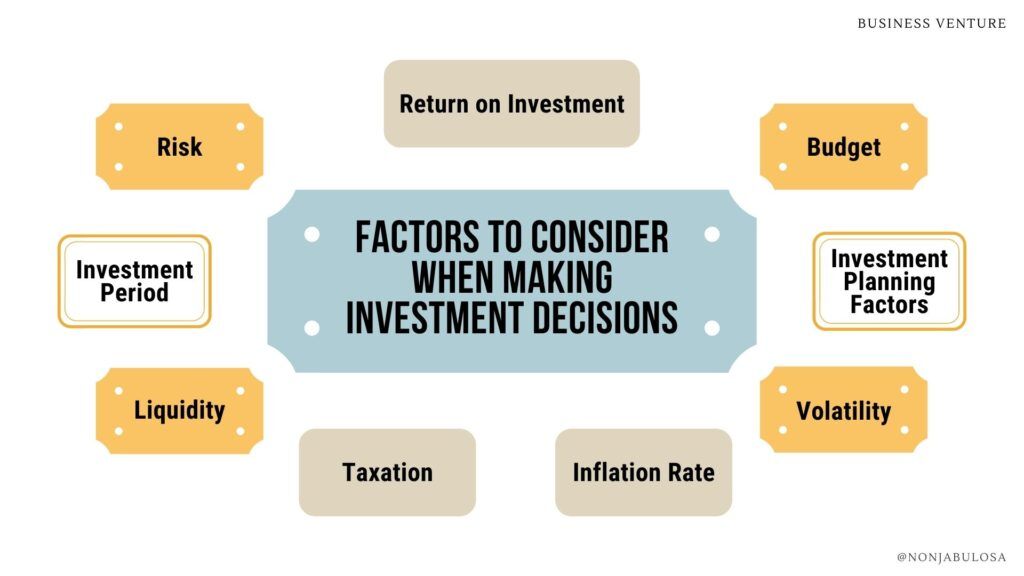

That solitary sentence might use to the job of picking your investments. Below are some fundamental concepts any type of financier ought to understand if they want to boost the effectiveness of their financial investment selection.Offer your cash time to expand and worsen. Determine your risk tolerance, then choose the kinds of financial investments that match it.

What Does Amur Capital Management Corporation Mean?

You require to devote to a time period during which you will certainly leave those financial investments untouched. A practical rate of return can be anticipated just with a long-term horizon. When investments have a long time to value, they're extra most likely to weather the unavoidable ups and downs of the equities market.

One more important reason to leave your financial investments untouched for several years is to take advantage of compounding. When you start earning cash on the money your investments have actually already made, you're experiencing substance development.

Examine This Report on Amur Capital Management Corporation

They get the benefit of compounding growth over a longer time period. Possession allocation means placing your financial investment funding into several types of investments, each standing for a percent of the whole. Assigning possessions into various classes that are not extremely associated in their price activity can be a highly reliable way of expanding danger.

If you wish to diversify your profile additionally, you could broaden beyond those two classes and include property investment company (REITs), assets, foreign exchange, or global supplies. To recognize the ideal allowance technique for you, you require to comprehend your tolerance for danger. If short-term losses keep you awake at night, focus on lower-risk alternatives like bonds (passive income).

How Amur Capital Management Corporation can Save You Time, Stress, and Money.

Nobel Champion economist Harry Markowitz referred to this benefit as "the only freebie in finance - https://www.magcloud.com/user/amurcapitalmc. mortgage investment." You will certainly make more if you diversify your profile. Below's an instance of what Markowitz suggested: A financial investment of $100 in the S&P 500 in 1970 would have expanded to $7,771 by the close of 2013

Now, imagine you take on both methods. If you had actually spent $50 in the S&P 500 and the various other $50 in the S&P GSCI, your overall financial investment would have grown to $9,457 over the same duration. This means your return would have gone beyond navigate to these guys the S&P 500-only portfolio by 20% and be virtually double that of the S&P GSCI efficiency.

The 8-Minute Rule for Amur Capital Management Corporation

Every little thing else takes very specialized expertise. If most investors can reach their goals with a combination of stocks and bonds, then the best concern is, how much of each course should they select?

The truth is, the overall return on stocks traditionally has actually been much greater than for all other asset classes. In his book Stocks for the Long term, writer Jeremy Siegel makes a powerful instance for creating a portfolio consisting mostly of supplies. His reasoning: "Over the 210 years I have examined supply returns, the genuine return on a broadly diversified profile of stocks has balanced 6. mortgage investment.6% annually," Siegel claims

Getting My Amur Capital Management Corporation To Work

"At the end of 2012, the return on nominal bonds was around 2%," Siegel notes. "The only means that bonds might produce a 7.8% genuine return is if the customer rate index fell by almost 6% per year over the next 30 years.

Instance in factor: At a rate of 3% inflation each year, $100,000 will be worth just $40,000 in thirty years. Your age is as appropriate as your character. As you get closer to retirement, you ought to take less dangers that might jeopardize your account equilibrium just when you need it.

Fascination About Amur Capital Management Corporation

In maintaining with the Pareto Principle, we'll take into consideration the 5 most vital elements. They are returns, P/E ratio, historical return, beta and profits per share (EPS). Returns are a powerful way to increase your revenues. The regularity and quantity of the returns go through the company's discretion and they are greatly driven by the business's monetary performance.

Report this page